Full disclosure: I love credit cards almost as much as I love credit card statistics. I have multiple cash-back credit cards, multiple travel rewards credit cards, a gas credit card (which doubles as my Costco credit card), and a few others too. I’m honestly not sure off the top of my head how many active credit card accounts I have.

I also take care to pay my credit cards on time and in full. I don’t recall ever carrying a credit card balance outside of an introductory 0% APR offer period. It’s possible I did when I was much younger, but I’ve never been in significant credit card debt.

These two facts — my overstuffed wallet and fastidious on-time, in-full payments — put me in a small minority of American credit card users. Most have far fewer cards to their name, and about two in five carry interest-bearing balances. If you’re curious about how your own credit card usage compares to the typical U.S. cardholder’s, you’re in the right place.

Credit Card Statistics on Average Debt in America — $2,810 Per Person and Over $6,000 Per Cardholder

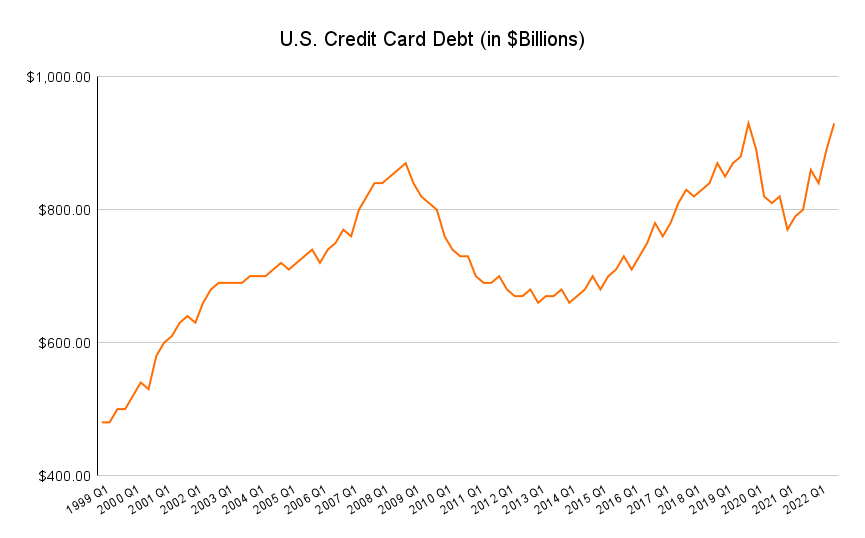

Our recent analysis of U.S. credit card debt trends found that Americans’ total outstanding credit card debt is $930 billion as of Q2 2022 (and rising). Divided by the approximate U.S. population of 331 million, that works out to an average credit card debt load of about $2,810 per person.

Of course, not all Americans can or do use credit cards. Many are too young — you generally have to be 18 or older to qualify for a credit card — and some can’t qualify due to very low credit scores, no credit history, or other factors. So the average credit card debt load among actual credit card users is much higher: more than $6,000, and still rising.

As we see from the chart above, Americans collectively have more credit card debt than at any point since the Federal Reserve Bank of New York began tracking it. This isn’t in and of itself a bad thing, but with credit card interest rates at historic highs and average available credit lines growing rapidly, it’s a potential financial threat for millions as the U.S. economy slows and job losses accelerate.

Credit Cards Outnumber Debit Cards by About 3:1

Again, not all Americans have any credit cards to their name. Because far more have at least one bank account — fewer than 10% of Americans remain unbanked or underbanked — you might think there are more debit cards in circulation than credit cards.

You’d be wrong. There are about three times as many credit cards as debit cards in American wallets, and the gap has actually widened in recent years. In 2019, the most recent year for which we have data, there were 1.08 billion credit cards (including debit cards with a credit function) in circulation, compared with just 325.4 million debit-only cards.

It’s clear that American consumers prefer the flexibility of credit to debit-only cards, which immediately deduct funds from your bank account and don’t allow you to run a balance. This is a double-edged sword, offering payment flexibility and potentially lucrative rewards on the one hand, and the risk of expensive, even crippling high-interest debt on the other.

Credit Card Statistics About Fraud — About 7% of Card Spending Is Fraud

According to Nilson Report, approximately $6.80 is lost to fraud for every $100 spent on credit cards in the United States. Put another way, about 6.8% of all U.S. credit card spending is fraudulent.

The credit card fraud rate has ticked down since 2016, when it hit a high of 7.2%. But it remains much higher than in 2010, when just 4.5% of U.S. credit card spending was lost to fraud.

Fortunately, individual credit card users don’t lose $6.80 for every $100 they spend on credit cards. (Credit card usage would quickly collapse were this the case.) The United States has strict consumer protection laws that basically require credit card companies to absorb fraud losses on their own balance sheets.

This is an unwelcome but manageable risk for credit card companies. It’s one of many factors in the inexorable rise in credit card interest rates and interchange fees in recent years, as credit card issuers look to make up revenue lost to fraud.

Average Credit Card Statistics on Interest Rates — 19.1%, Currently at Historic Highs

Turning back to carried balances: We’ve seen a rapid, concerning rise in interest rates on credit card balances since early 2022. The average interest rate on all open U.S. credit card accounts was 19.1% (and still climbing) in November 2022

In fact, according to our recent analysis of average credit card interest rates by year, credit card interest rates are as high as they have ever been — and by a significant margin.

From when the Federal Reserve Bank of St. Louis began tracking credit card interest rates in 1994 until 2022, average rates remained below 17.5%. However, once the Federal Reserve began raising the federal funds rate in March 2022, credit card rates skyrocketed — gaining nearly 400 basis points (4%) in less than a year.

This is unsurprising because credit card rates are increasingly closely linked to the federal funds rate, but it’s deeply concerning for Americans whose credit card balances now cost significantly more on a monthly basis.

More Credit on Credit Cards Is Available Now Than Ever

With interest rates at all-time highs, you’d think credit card users would pull back, or that issuers would tighten the credit tap for fear that marginal users might fall behind on their payments or default on their debts.

That could still happen, especially if the U.S. economy tips into recession, but we see no evidence of it so far. According to data collected by the Federal Reserve Bank of New York, available credit has steadily increased since 2010 — from about $2 trillion in Q1 of that year to about $3.5 trillion in Q4 of 2022.

In other words, were every credit card user in America to suddenly decide to max out every credit card they owned, they could collectively spend nearly twice as much today as they could have in early 2010.

Most Americans don’t max out their credit cards or even come close, which is why total outstanding credit card debt remains below $1 trillion today. That’s approximately 30% of the theoretical total, which is why we say Americans’ total credit card utilization is approximately 30%.

It would be bad if credit utilization rates climbed much farther. Higher credit utilization is a sign of financial stress at the macro level: consumers’ expenses rising faster than their incomes, unemployed or underemployed people putting basic expenses on credit cards after draining their bank accounts, and so on. Credit card delinquency rates generally rise to match.

Unfortunately, thanks to inflation, prices are still rising faster than incomes, and unemployment is widely expected to rise in 2023 and 2024 as the economy slows. It’s looking more and more like credit card delinquency rates — recently at multidecade lows — have bottomed out for the time being. They could soon rise in a big way.

Delinquency Rates Have Mostly Declined Since 2009 — But They’re Rising Again

The credit card delinquency rate — the percentage of credit card accounts more than 30 days late on payments — touched a 30-year low of 1.55% in Q3 2021. Back then, American consumers were still flush with pandemic stimulus and inflation was only just awakening from its decade-long slumber.

Today, it’s a very different world. Delinquencies remain low by historical standards — 2.08% as of Q3 2022 — but they’re rising fast on a steepening curve. At the current pace, the U.S. credit card delinquency rate will top its 10-year high water mark — 2.66%, set in Q1 2020 — by the end of 2023.

What happens next is anyone’s guess. Here’s mine: Through 2024, credit card delinquency rates will climb farther and faster than mortgage delinquency rates, topping out between 3.3% and 3.6% sometime in 2024. They’ll remain elevated by recent historical standards even after the relatively shallow recession of late 2023 and early 2024 ends, similar to the hangover that followed the Great Financial Crisis of 2008.

Back then, credit card delinquency rates touched 6.77% in Q2 2009. They fell briskly after that, passing 4% by early 2011, but didn’t bottom out until early 2015. Because they won’t race as high this time, I don’t expect a quick fall either, though by late 2025 I think we’ll see delinquency rates back below 2.5% and more or less steady.

Credit Scores Are At All-Time High and Still Climbing

One important reason I don’t expect credit card delinquency rates to approach GFC-era highs is because Americans’ credit scores have never been higher, at least since our records began. The average FICO score hit 714 in 2021 and continued climbing in 2022 and 2023 — solidly within the “good” credit range (670 to 739).

The steady growth in FICO scores since the GFC is partly due to Americans’ slowly but steadily improving balance sheets (especially after multiple rounds of pandemic stimulus) and partly due to improvements in credit underwriting, which have indirectly helped consumers use credit more responsibly. Americans are both smarter about how they use credit today and less dependent on risky leverage — namely, credit cards and adjustable-rate home equity products — than they were in the 2000s.

The party won’t last much longer. As inflation continues to erode purchasing power, recession looms, and delinquencies increase, I expect the average FICO score to dip slightly into 2025 while still remaining comfortably above 700. But don’t look for a repeat of the GFC and its aftermath.

Final Word

All things considered, American credit card users are in pretty good shape. They have access to more credit than ever yet aren’t using most of it, their credit scores are high and rising, they’re overwhelmingly on time with their payments, and strong consumer protection laws ensure they don’t have to worry about fraud in the vast majority of cases

Then again, it’s likely that the present moment is an unusually sunny one for credit card users. With growing economic headwinds and leading indicators of financial stress becoming more difficult to ignore, not to mention already sky-high interest rates pressuring folks who carry balances, I expect U.S. credit card users to have a rougher go of it in 2023 and 2024. If you’re at a financial crossroads, now’s the time to finally get serious about paying down your credit card debt.